So far as I am able to find out, Precision Ski and Sport is the only business in all of Summit County, Colorado that accepts payment in bitcoin. As one might expect, the only way that this merchant accepts bitcoin is via the Lightning network.

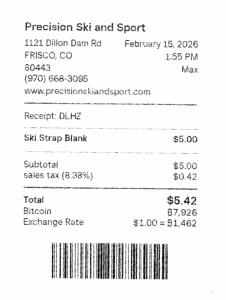

As you can see from the cash register receipt shown at right, there is a “units” problem. It is not true that 1462 bitcoin equal one dollar, as shown on the receipt. 1462 bitcoin actually add up to slightly more than one hundred million dollars. It is also not true that I paid 7926 bitcoin. If I had paid that number of bitcoin, I would have been handing over more than half a billion dollars.

A moment’s reflection reveals that the receipt should have used a unit of satoshis (sats). My purchase was about 7926 sats (not bitcoin). The exchange rate was about 1462 sats (not bitcoin) to the dollar.

The natural next question is whether the transaction really did settle as fast as lightning, and the answer is, yes it did.

The alert reader also wonders what fees were incurred. As the sender, I incurred a fee of three sats, which amounts to about ⅕ of a cent, or about 0.04% of the amount being paid. The merchant incurred no fee, because the payment service provider (Square) is waiving its fees on bitcoin through the year 2026. Square says that starting in 2027, it will charge a 1% commission for processing bitcoin.

I carried out this transaction using Muun, which seems to be the most popular self-custodial Lightning network wallet for Android. It seems to me that Muun is a must-have for the Android user who wants to carry a little “walking around money” for in-person incidental purchases such as the occasional cup of coffee.

I carried out this transaction using Muun, which seems to be the most popular self-custodial Lightning network wallet for Android. It seems to me that Muun is a must-have for the Android user who wants to carry a little “walking around money” for in-person incidental purchases such as the occasional cup of coffee.

The alert reader wonders, what exactly was the payment process? What happened when I walked into Precision Ski and Sport and tried to purchase that five-dollar ski strap?

The sales clerk tapped on the screen of the Square cash register to select the merchandise (here, that five-dollar ski strap). The clerk then tapped on the screen to select “bitcoin” as the type of payment. From my point of view as a customer, what happened next was that a display showed a QR code with a small ₿ symbol in the center of the QR code. I opened the Muun app my smart phone, tapped in my PIN code, and clicked to ask the app to scan the QR code. Next, the app displayed the number of sats to be paid (7926 sats) and the fee that I would pay (3 sats). I was invited to click “confirm”, which I did. Within one second, the cash register said “approved” and my app said the same. It was as quick as quick could be.

Why Muun? One important factor, I suggest, is that there is no KYC or AML (know your customer or anti-money-laundering) formality for Muun. A person can carry out all of the steps to create and fund and make use of a Muun wallet without having to show a government ID or provide any other personal information. Muun is simple and easy to use and it works.

The normal funding path would be to load the Muun wallet with some “pocket change” amount of money (I chose to fund mine with about $50 worth of bitcoin, using an on-chain transfer from my Trezor wallet). The way to do this would normally be an on-chain transfer from a person’s cold (hardware) wallet. One would then “top up” the Muun wallet from time to time to maintain the intended “pocket change” amount of money.

As I said above, it seems to me that Muun is a must-have for the Android user. But by this I do not at all suggest that anyone should use Muun as one’s way of buying and holding bitcoin generally. I think the correct use case for Muun is as a substitute for the pocket change that one might use to pay for a cup of coffee. As yourself how much cash you might carry around in a pocket or purse or billfold for incidental in-purchases. That amount of money, and not more, is what I think you should hold in your Muun wallet.

If you were to click around on the internet to see user reviews of Muun, you would find some negative reviews and gripes. As best I can see, nearly all of the gripes and negative reviews are from people who were trying to use Muun for something that it was never intended to do. For example, some reviewers mistakenly try to use Muun as a buy-and-hold wallet solution for large amounts of cryptocurrency. Muun is best understood as a “hot wallet”, meaning a wallet storing its on-chain crypto keys in a place that could get infected with a virus or malware (to wit, a smart phone). It is, in my view, daft to use any wallet other than a cold hardware wallet for buy-and-hold of large amounts of cryptocurrency. (It is also, in my view, daft to use any make of a cold hardware wallet other than Trezor, for a lot of reasons that I discuss here.) A hot wallet is appropriate only for the modest amount of money that we would term “walking around money”, by which we mean the amount of cash that you might carry in your billfold or pocket or purse.

Other reviewers gripe that a Muun wallet is incapable of holding any cryptocurrency other than bitcoin. Again it seems to me that such a reviewer is trying to use Muun for something that it was never intended to do. I predict that no cryptocurrency other than bitcoin will ever come into everyday use for “walking around money”. I further predict that on-chain bitcoin transfers will never come into into everyday use for “walking around money”, for a number of reasons including:

- nobody who is trying to pay for a cup of coffee is going to want to stand around for ten minutes or more to wait for a payment to get recorded in a new block on the chain; and

- nobody is going to want to incur a fee of tens of cents for such a transfer.

I think that right now in 2026, it is already settled that the kind of bitcoin transfer that makes sense for “walking around money” is Lightning network bitcoin.

For such reasons, the fact that a Muun wallet is not able to hold any cryptocurrency other than bitcoin is not an interesting fact. At this point in 2026, the sole cryptocurrency payment system that makes any sense for “walking around money” is, in my view, Lightning network bitcoin. Square, which is one of the world’s best-established systems for retail point-of-sale (POS) terminals, has singlehandedly settled it that Lighting network bitcoin is now and will always be the system of choice for “walking around money”. No other POS service or equipment provider is ever going to attempt to legitimize any other retail payment solution for bitcoin, and no cryptocurrency other than bitcoin is going to move into the mainstream for POS systems.

At this point in 2026, when people are splitting a restaurant check or reimbursing each other for small amounts of money, the typical payment methods used are Zelle and Venmo. I predict that as time goes on, more and more people will have a Lightning network app on their smart phone and will be able to use Lightning to settle up many of the small personal payments that until now would get done through Zelle or Venmo. I also predict that as time goes on, the smart phone app that many will use for Lightning transfers is Muun.

Have you used Lightning? Have you set up your Square point-of-sale system to receive bitcoin? Have you made use of a Muun wallet? Do you favor some other “pocket change” wallet for smart-phone usage? Please post a comment below.

Leave a Reply